Like in any dispute, one of the parties are at fault. It can be you (the Insured) or the Insurance Company. How can you avoid the common disputes of Medicalim claim ?

Please read up about “understanding your policy”

Where the fault lies with the Insured (You) , the commonest reason is that the policy was not read properly. You need to understand the gross areas of your Insurance policy and also look up the fine prints and submit the important documents.

Please check that the claims fits into the Basic part of the Policy

Here are the BASICS :

sum assured

period of insurance

sublimits,

exclusions

waiting periods

What is the solution ? In peace time please read up the policy documents carefully. If you find it too complicated then have someone explain it to you. While filling up the claim form you must ask yourself that if you are the Insurance company which points will you use to reduce the claim amount? Make sure that the claimed amount is within sum assured including sublimits, within the policy period and does not fall in the exclusion or waiting category.

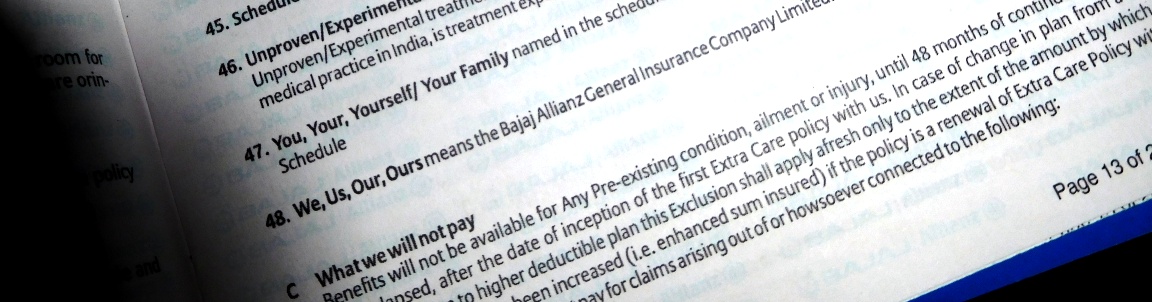

Please read up about the exclusion ……

Please read up about the waiting periods….

Next check if the claim violates some of the fine prints in the Policy

This can be tricky and fine prints are some times unfair to the patient. Eg You might have taken a day care treatment for a disease but the policy requires you to stay for more than 24 hours.

One Insurance company rather than saying “do not pay your surgeon separately but include his fees with the hospital bill” will simply say “ nothing is payable except under clause 1.2 “. You are supposed to know that clause 1.2 refers to Hospitalisation bill.”

Ensure that Key Documents are filed

You need to file the original documents. If you lose the original documents , then it is a complicated process requiring police report of the loss and then a declaration before the first class magistrate that the documents are lost. If you have two policies and you need to file the claim in both the policies then you have to collect the attested photocopy from one company and submit it to the other company. Other documents such as Aadhar and PAN card need to be filed.

Please read up about the commonly missed documents…

IF YOU HAVE DONE THESE CHECKS THEN IN CASE OF A DISPUTE YOU WILL HAVE AN UPPER EDGE