Your Mediclaim policy document runs into many pages. There are certain critical areas of the policy document which you need to focus and keep a note because they are relevant when a claim comes up.

-

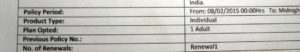

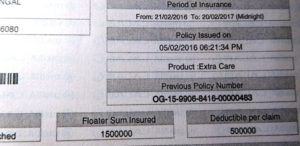

Dates

Please check the start and end date of the policy.

-

Number of renewals

Please check the number of renewals in the policy. If in doubt it is best to preserve the last four years Mediclaim policy. The waiting time for various procedures and pre existing disease clauses are determined by the number of renewals. Eg If you need a hernia surgery, it is usually excluded in the first year. If you had hypertension at the time of getting the policy, complications of hypertension i.e. Stroke is usually excluded for the first four years from the start of the policy. The renewal history of the past four years is important to calculate these waiting periods.

-

Hospitalisation or Critical Care Policy

The Hospitalisation policies give out a payment for claim only if there is a period of hospitalsiation. The critical care policies give out a claim if there is any of the listed critical care conditons eg renal failure, hearth disease requiring open heart surgery.

-

What is the duration of cover for Pre and Post Hospitalisation ?

The standard period is that you would get reimbursed for the expenses incurred in 30 days before admission to the hospital and for 60 days after discharge from the hospital. This helps you to plan your claim so as to get the best reimbursement in case of claims for prologed treatment period eg breast cancer surgery. The dates might vary.

-

Exclusions

There is a long list of exclusions. The common exclusions are , dental treatment, cost of glasses, congenital and degenerative diseases , cosmetic surgery, pregnancy and related complications are generally excluded but some policies might cover it. However, ectopic pregnancy , where a pregnancy develops in the fallopian tube and might rupture and cause life threatening internal bleeding , is generally included and not considered under pregnancy related exclusion .

Read more about the “EXCLUSIONS”

-

Wating Period

There is a list of waiting periods. Cataract surgery might be excluded in the first one or two years and knee replacement might be excluded in the first four years. Exact waiting periods are clearly spelt out in the policy.

Read more about the “WAITING PERIODS”

-

Third Party Agent

Be clear about your Third Party Agent who will be processing your claims on behalf of your insurance company. The name and address of the TPA is clearly mentioned in your Health Insurance ( Mediclaim ) policy. Ususally a TPA card arrives soon after aquiring a policy but can also be downloaded from the website of the TPA using your policy number or other details like a customer ID of the policy. The TPA ID number does not change even for renewal polices.

-

Notice period

The policy spells out that a notice of claim needs to be sent to the TPA before any hospitalisation . Usually it is anything between 48 to 72 hours before hospitalisation. However, for emmergency conditions it is not important. The notice of claim is needed to be sent to the TPA and can be sent by electronic means too. The Insurance Agent often does the intimation for you.

-

Sublimits

The policy will mention the sublimits for your room category, ICCU bed charges ,doctors fees and operation theater charges . If you have a 1% room limit then for a 2 lacs policy you will be paid for upto Rs 2000 for your room.

There is usuallly a clause that there will be proportional reduction of other charges. Here is an example. If your room sublimit is Rs 2000 and your have taken a room for Rs 3000 then the Insurance Company might interpreat this as having exceeded the room charge by 50 % and might deduct 50 % of all other charges i.e. They will then pay 50 % of Doctors fees and 50% of operation theater fees. Cost of medicine is excluded from the “proportionate reduction”.

There might be a separate premium to waive this clause.

-

Hospital Cash

Some policies give out cash payment depending on the duration of hospital stay. Find out from your policy.

-

Ambulance Charges

Some Policies give out a specified amount as ambulance charge. Find out from your policy.

-

Time Limit for filing your claim

The time limit for filing your claim is usually between 7 to 15 days after discharge from hospital for hospitalisation and post hospitalisation cover. However, IRDA regulation says that Insured companies need to be reasonable while enforcing the time limit for claim filing. In the of delay a valid explanation may be given.

Stay healthy and always hope that you will never have to use your Health Insurance Policy !!!!

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.